In the days that followed a weekend collapse of two US banks, the Biden Administration is doing what it can to resolve the situation.

Both the Silicon Valley Bank in California and New York-based bank Signature Bank, collapsed financially and over the weekend, the White House released a statement from President Joe Biden that at his direction, the federal bank insurer, FDIC, took control of both banks assets. Biden also said in another statement that the management of both banks will be fired for allowing these situations to happen.

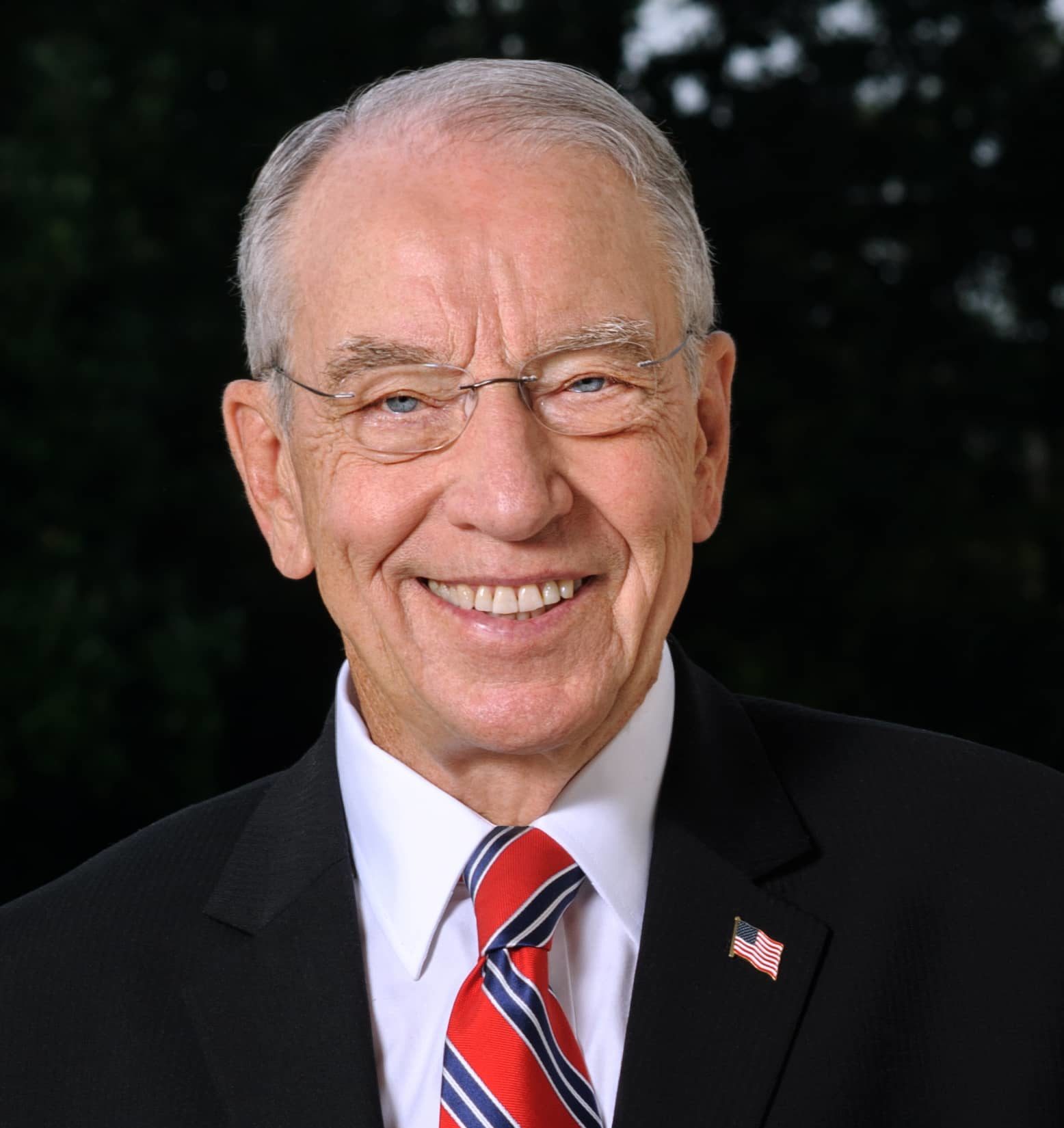

Senator Chuck Grassley questions if the Federal Reserve has the authority to intervene and protect the deposits that were made in these banks. He personally believes this is looked at as a bailout overall for the high tech industries of California and Silicon Valley Bank itself.

“This bank was doing probably much more business with high tech than they should’ve, they weren’t spreading their risk as much and then another place where they thought they were protecting themselves – but they made themselves very vulnerable – is when they had a lot of (federal) government bonds with low interest rates, and then the government raises the interest rates and the banks lose their value. And so in that particular case, they had about 50-percent of their investment in government bonds, where the typical bank has about 30-percent.”

Biden further commented that anyone who had deposits with these banks will have access to their money moving forward and for small businesses, they can pay their employees and keep their businesses functioning. Biden stressed that there will be no cost to taxpayers to help with this situation, but that the investors of these banks will not be protected.